Debt-Free or Invest First?

Making the Smartest Choice for Your Financial Future

Debt-Free or Invest First?

Making the Smartest Choice for Your Financial Future

The truth isn’t one-size-fits-all, and the right choice could mean the difference between financial freedom and years of missed opportunities. Let’s break it down so you can make the smartest move for your future… 👇💰

Understanding the Dilemma

Debt can feel like a heavy burden, holding you back from financial security. At the same time, waiting too long to invest means you might miss out on the power of compound interest, one of the greatest wealth-building tools available. So, how do you strike the right balance between paying off debt vs investing?

The answer depends on your financial situation, your goals, and the type of debt you have. Let’s explore both options in-depth to see what makes the most sense for you.

The Case for Paying Off Debt First

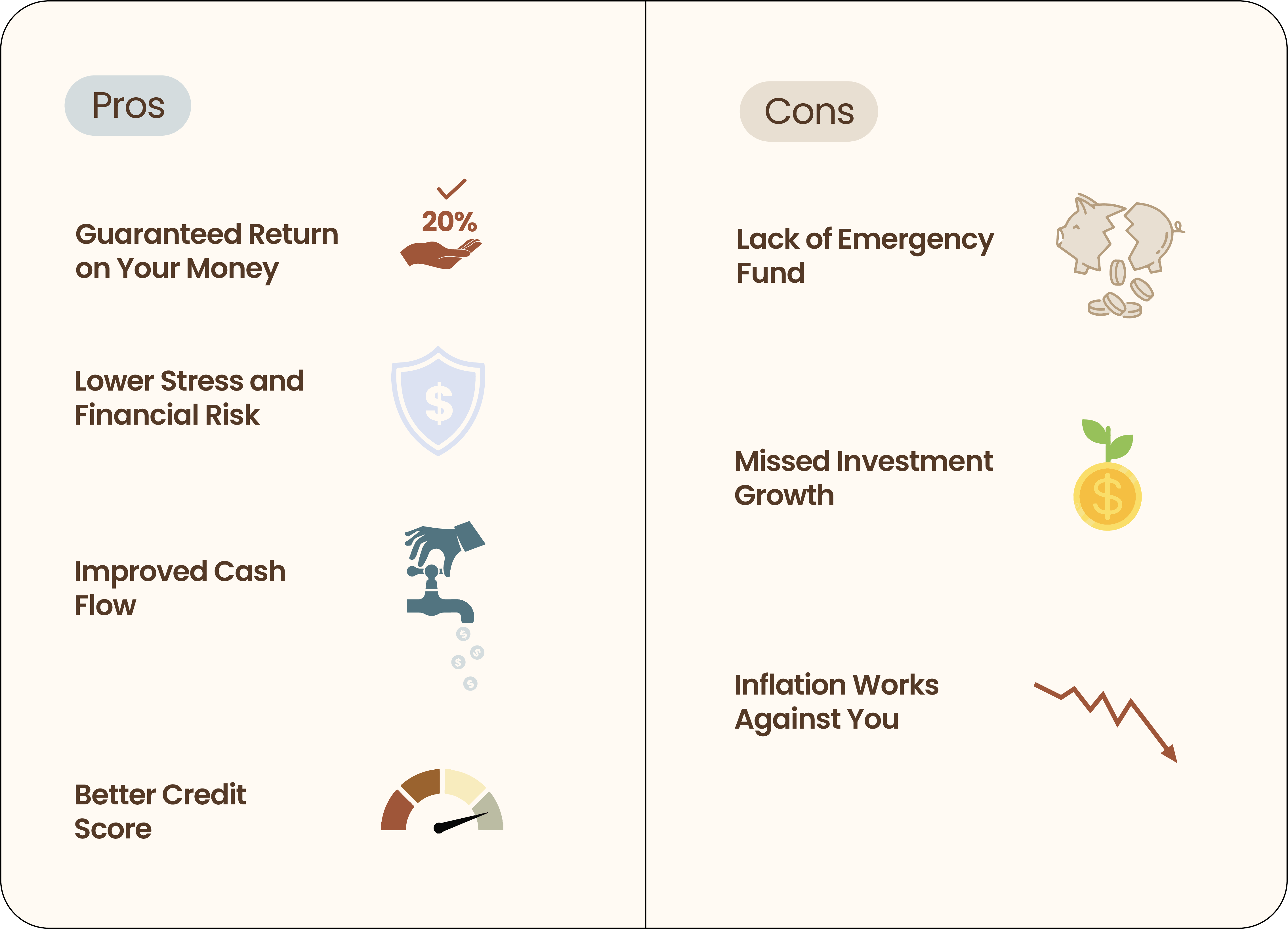

✅ Pros:

- Guaranteed Return on Your Money – When you pay off debt, you effectively earn a guaranteed return equal to the interest rate you were paying. If you have a credit card charging 20% interest, paying it off is like earning a 20% return—risk-free.

- Lower Stress and Financial Risk – Debt can be emotionally and financially draining. Paying it off reduces financial strain and gives you more control over your future.

- Improved Cash Flow – Once debt payments are gone, you have more disposable income to invest, save, or spend on things that align with your goals.

- Better Credit Score – Lower debt levels can improve your credit score, making it easier to qualify for lower interest rates on mortgages, car loans, and other financial opportunities.

❌ Cons:

- Lack of Emergency Fund – If you throw all your money at debt and an emergency arises, you might have to rely on credit again, putting you back in the same cycle.

- Missed Investment Growth – The earlier you start investing, the more you benefit from compound interest benefits. Delaying investing could mean missing out on decades of potential growth.

- Inflation Works Against You – If your debt has a low interest rate (e.g., student loans or a mortgage under 5%), your money might grow faster in the stock market than what you’d save by paying off the debt early.

The Case for Investing While Paying Off Debt

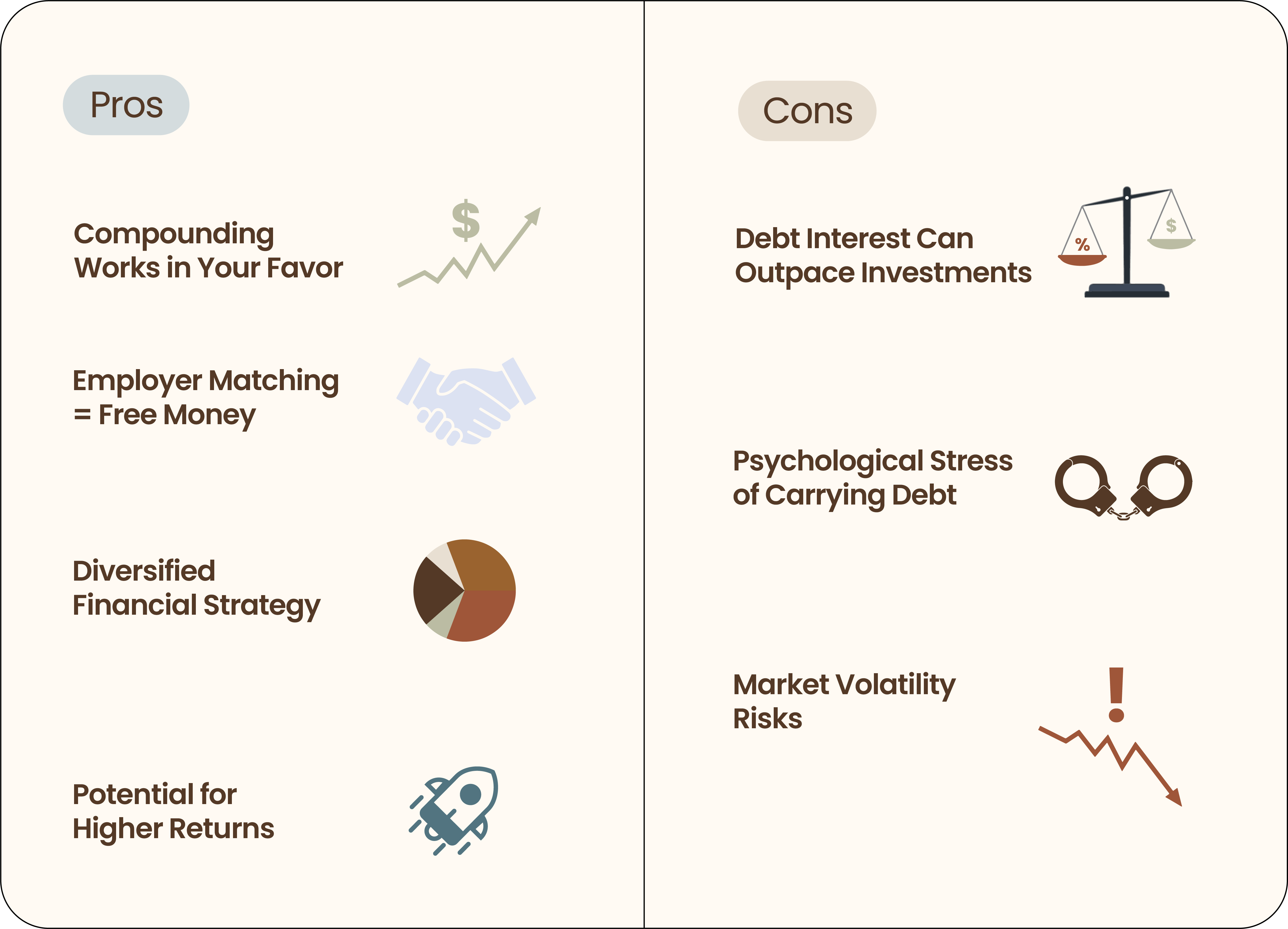

✅ Pros:

- Compounding Works in Your Favor – The earlier you invest, the more time your money has to grow. A small amount invested in your 20s can be worth far more than a larger amount invested in your 40s.

- Employer Matching = Free Money – If your job offers a 401(k) matching contribution, contributing enough to get the full match is often a smarter move than paying off low-interest debt.

- Diversified Financial Strategy – By investing while paying off debt, you’re spreading out your financial approach, ensuring you’re not solely focused on debt repayment without building assets.

- Potential for Higher Returns – Historically, the stock market has averaged 7-10% returns annually. If your debt has a low interest rate, investing might yield a higher return than aggressively paying off that debt.

❌ Cons:

- Debt Interest Can Outpace Investments – If you have high-interest debt (credit cards, payday loans), the return on investing likely won’t match what you’re losing in interest.

- Psychological Stress of Carrying Debt – Some people simply feel better being debt-free, and the peace of mind might be worth more than potential investment gains.

- Market Volatility Risks – Investments aren’t guaranteed. If you invest while still carrying significant debt, a downturn in the market could leave you struggling financially.

Finding the Right Balance: A Smart Strategy

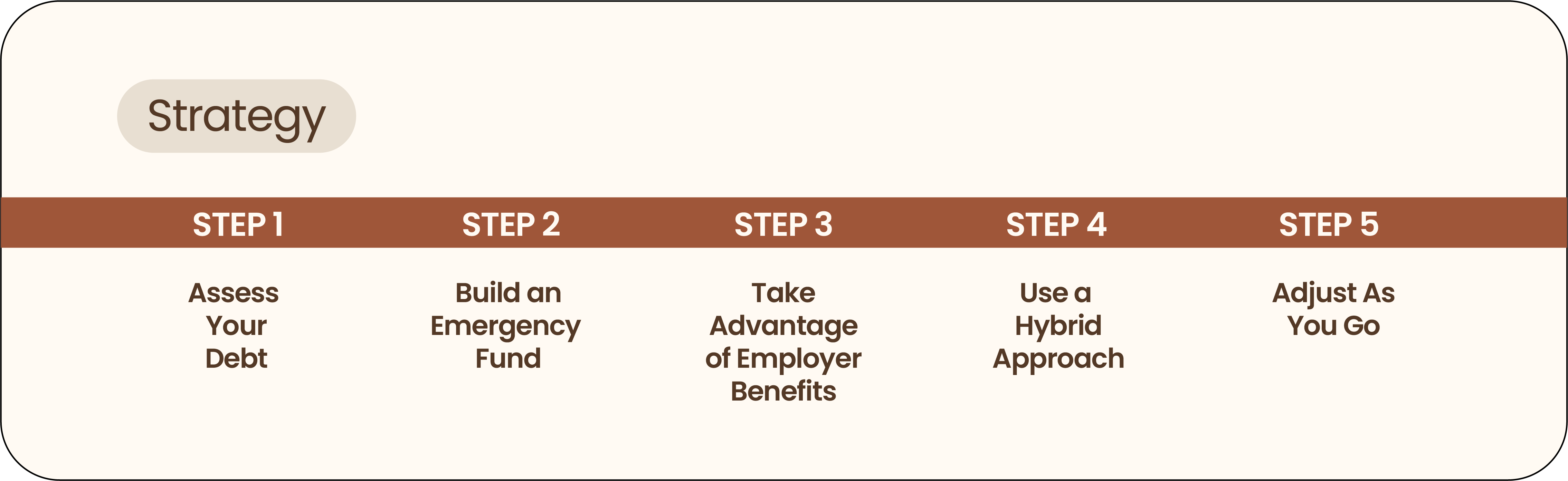

Since neither approach is perfect for everyone, here’s a step-by-step plan to help you decide:

Step 1: Assess Your Debt

- High-Interest Debt (>7-8%): Prioritize paying this off ASAP.

- Low-Interest Debt (<5%): Consider investing while making minimum payments.

- Moderate-Interest Debt (5-7%): Weigh your options—if investing seems promising, split your focus.

Step 2: Build an Emergency Fund

Before aggressively paying off debt or investing, ensure you have at least 3-6 months’ worth of expenses saved. This prevents you from relying on debt in case of an emergency.

Step 3: Take Advantage of Employer Benefits

If your employer offers a 401(k) match, contribute enough to get the full match—it’s free money you don’t want to miss.

Step 4: Use a Hybrid Approach

If your debt isn’t crippling, consider a balanced plan:

- 50% of extra money goes toward debt

- 50% goes into investments

This way, you’re tackling debt repayment while also benefiting from investment growth.

Step 5: Adjust As You Go

Your financial situation will evolve. Regularly assess your strategy to ensure it aligns with your goals.

Key Takeaways

- Pay off high-interest debt first (credit cards, payday loans) before investing.

- Invest while paying low-interest debt if your investments can generate better returns.

- Always contribute to a 401(k) match—it’s free money.

- Build an emergency fund before aggressively tackling debt or investments.

- Find a balance that works for you—financial wellness is personal.

Final Thoughts

There’s no single right answer. The best strategy depends on your personal circumstances, risk tolerance, and financial goals. Whether you choose to pay off debt or invest first, or take a hybrid approach, the key is making informed, intentional decisions that move you toward financial freedom.

By understanding the trade-offs and creating a plan that works for you, you’ll set yourself up for long-term success. 🚀💰

Need help making a financial plan that fits your life? Contact us today for expert guidance tailored to your goals!